Find out if you qualify for SETC Tax Credits

You May Qualify for SETC / FFCRA Tax Credits

FFCRA - Families First Coronavirus Response Act

- If you missed days from Covid-Related Illness in 2020 and 2021

- If your kids missed school

- If you were quarantined because of Covid

- If you took care of a family member or loved one

- If you suffered from the Covid vaccine

This is a COVID Relief Refund from the US Treasury called FFCRA Tax Credit Refund of

the taxes you already paid for

enduring Covid-19 from 2020 and or 2021.

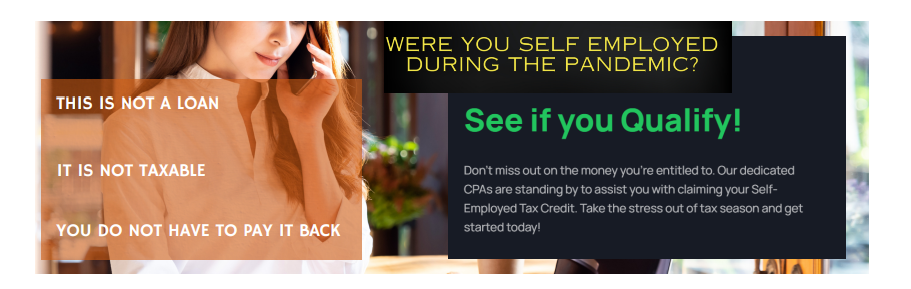

This is NOT a loan; and you

do NOT have to pay it back!

For a

FREE Consultation

with a member from our team

Call: 877-749-3195

Let the tax experts help you qualify for FFCRA today! Qualify for SETC

What is FFCRA?

Families First Coronavirus Response Act (FFCRA) provides small and midsize employers refundable tax credits that reimburse them, dollar-for-dollar, for the cost of providing paid sick and family leave wages to their employees for leave related to COVID-19 1. The IRS has released a new form, Form 7202, that is available for eligible self-employed individuals to claim sick and family leave tax credits under the American Rescue Plan which is called FFCRA.

Eligible self-employed individuals will determine their qualified sick and family leave equivalent tax credits with the new IRS Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals.

How to Claim SETC Tax Credit:

To claim the Self-Employed Tax Credit (SETC), you will need to submit amended 2020/2021 tax returns to the IRS. The refundable credits are claimed on a self-employed individual’s Form 1040, U.S. Individual Income Tax Return. Let the experts at Jorns and Associates help you file your SETC Claim Today!

Who we are:

We are a team of experienced tax professionals, with over 500 CPA’s, tax attorneys, and IRS agents that examines your claim and files he necessary paperwork directly to the IRS at no up-front cost. Our modest fee is paid at the end. With our proprietary software we have assisted thousands of businesses and individuals in obtaining billions of dollars of ERC Tax Credits and now you are entitled to receive SETC Tax Credits.

Let the experts at Jorns & Associates help you submit your SETC tax credit filing to the IRS to account for your circumstances during Covid-19 accurately, confidentially and securely.

To speak to a member from our team please fill out the form Call: 877-749-3195

How do I Qualify for FFCRA / SETC Tax Credits?

1. Set-up a FREE Account

Setting up a FREE Account takes 45 secs to Pre-Qualify. It's easier than you think. You’ll be contacted by one of our tax professionals on how to sign in to Jornstax.com and to upload your documents.

Qualify for SETC Tax Credits

2. Upload your documents

Upload a questionnaire and 2019, 2020 and 2021 pdf tax returns to the jornstax.com portal. From that point you will have access to view the process every step of the way.

Qualify for SETC Tax Credits

3. Receive your refund

Then based on your eligibility, the number of days you were impacted, and how many loved ones you cared for during Covid, you could receive a tax refund of up to $32,220.

Set up a FREE Account

For a free consultation fill out the form below:

We will get back to you as soon as possible.

Please try again later.

SPECIAL OFFER FOR FIRST-TIME PATIENTS

5802 S Memorial Dr.

Tulsa, OK 74145

Bewley Chiropractic - Copyright 2015 - All Rights Reserved

Disclaimer:

The information provided on this site, including recipes, medical content and our ASK US is for informational purposes only. It is not to be construed as medical care or medical advice and is not a replacement

for medical care given by physicians or trained medical personnel. Bewley Chiropractic practices a form of alternative medicine that focuses on diagnosis and treatment of mechanical disorders of the

musculoskeletal system, especially the spine, under the belief that these disorders affect general health via the nervous system and does not dispense medical advice, diagnosis, treatment or any other

medical service as part of this free web site. Always seek the advice of your physician or other qualified healthcare provider(s) when experiencing symptoms or health problems, or before starting any new treatment.

Bewley Chiropractic is not to be held responsible for any inaccuracies, omissions, or editorial errors, or for any consequences resulting from the information provided. By continuing to view this site, visitors

indicate acceptance of these terms. Visitors who do not accept these terms should not access, use, interact with or view these web pages.Information on this site should not be used without consulting a medical professional who is experienced in the administration of the ketogenic diet. The information included on this site is not tailored to meet the specific nutritional requirements of all individuals. Serious harm and even death could occur if the ketogenic diet is utilized without proper oversight from medical professionals. The ketogenic diet in any form or ratio should NEVER be started without the guidance of a qualified ketogenic diet team. It is your responsibility to evaluate the information and results from tools we provide. If you are a health care professional, you should exercise your professional judgment in evaluating any information, and we encourage you to confirm the information contained on our website with other sources before undertaking any treatment or action based on it. If you are a consumer, you should evaluate the information together with your physician or another qualified health care professional.

To see if you qualify for SETC Tax Credits from FFCRA Visit: FFCRA

We've worked with Blueprint Web LLC to help make this site great.

For FFCRA - SETC Tax Credit Visit: www.ffcrataxrelief.com

Tulsa Eyelash Extensions

For Weight Loss Visit: SkinnyCoffeehouse.com

Tulsa Colonics

Tulsa Car AccidenNet

For Nerium Opportunity Visit: Nerium Skin Care

Click here for SETC Tax Credits